When it comes to mortgages, it is easy to focus on the rates and your current situation, but the reality is that life happens and when it does, rates won’t be the only thing that matters.

First and foremost, the most important thing to remember is that a mortgage is a contract. That means that there is a penalty involved if the contract is ever broken. This is something that every homeowner agrees to when you sign mortgage paperwork, but it can be easy to forget – until you’re paying the price.

why break your mortgage?

You’re probably wondering why you would ever break your mortgage contract? Well, you might be surprised to find out that 6 out of 10 mortgages in Canada are broken within 3 years and there are typically nine common reasons that this happens:

- Sale and purchase of a new home

- To utilize equity

- To pay off debt

- Cohabitation, marriage and/or children

- Divorce or separation

- Major life events (illness, unemployment, death of a partner)

- Removing someone from title

- To get a lower interest rate

- To pay off the mortgage

It is always important to think ahead when signing a mortgage agreement, but not everything can be planned for. In that event, it is important to understand the next steps if you do indeed need to break your mortgage.

calculating penalties

Typically, the penalty for breaking a mortgage is calculated in two different ways. Lenders generally use an Interest Rate Differential calculation or the sum of three months interest to determine the penalty. You will typically be assessed the greater of the two penalties, unless your contract states otherwise.

INTEREST RATE DIFFERENTIAL (IRD)

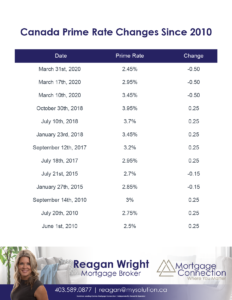

In Canada there is no one-size-fits-all rule for how the Interest Rate Differential (IRD) is calculated and it can vary greatly from lender to lender. This is due to the various comparison rates that are used.

However, typically the IRD is based on the following:

- The amount remaining on the loan

- The difference between the original mortgage interest rate you signed at and the current interest rate a lender can charge today

In this case, these penalties vary greatly as they are based on the borrower’s specific mortgage and the specific rates on the agreement, and in the market today. However, let’s assume you have a balance of $200,000 on your mortgage, an annual interest rate of 6%, 36 months remaining in your 5-year term and the current rate is 4%. This would mean an IRD penalty of $12,000 if you break the contract.

Ideally, you will want to be aware of what your IRD penalty would be before you decide to break your mortgage as it is not always the most viable option.

THREE MONTHS DIFFERENCE

In some cases, the penalty for breaking your mortgage is simply equivalent to three months of interest. Using the same example as above – balance of $200,000 on your mortgage, an annual interest rate of 6% – then three months interest would be a $3,000 penalty. A variable-rate mortgage is typically accompanied by only the three-month interest penalty.

paying the penalty

When it comes to making the payment, some lenders may allow you to add this penalty to your new mortgage balance (meaning you would pay interest on it). You can also pay your penalty up front.

Whenever possible, if you can wait out your current mortgage term before making a change to your mortgage, it is the best way to avoid being stuck in the penalty box. If you cannot avoid a penalty, do note that, while only calculators can be great tools for estimates, it is best to call your lender or mortgage broker directly for the accurate number in the case of determining penalties.

If you are unsure about getting the best penalty terms, reach out! reagan@mysolution.ca